Exploring the Exponential Moving Average (EMA) in Trading

Many technical indicators are employed to analyze price trends and make informed decisions. One such indicator is the Exponential Moving Average (EMA). The EMA is a popular tool used by traders all over the world to identify potential entry and exit points in the market. In this blog post, we will take a look at EMA, its calculation methodology, interpretation, and practical applications in trading strategies in this guide by Pyjamastraders.

1. Understanding Moving Averages:

Before diving into the specifics of EMA, it is crucial to grasp the concept of moving averages (MAs). MAs are statistical calculations that smooth out price data over a specified period, providing a clearer picture of market trends.

2. Introducing the Exponential Moving Average:

The Exponential Moving Average is a type of moving average that assigns more weight to recent price data, making it more responsive to current market conditions compared to other types of MAs.

3. Calculating the EMA:

The calculation of EMA involves a multi-step process that incorporates a smoothing factor known as the smoothing constant or alpha value. This constant determines how much weight is given to recent price data.

4. Interpretation and Applications of EMA:

4.1 Identifying Trend Reversals:

EMA can be used to identify potential trend reversals by observing the crossover of shorter-term and longer-term EMAs. This technique is commonly referred to as the “EMA crossover strategy.”

4.2 Determining Support and Resistance Levels:

EMA can also help traders identify key support and resistance levels, which are crucial in determining potential entry and exit points.

4.3 Generating Trading Signals:

By analyzing the relationship between price and EMA, traders can generate buy or sell signals. These signals are often used in conjunction with other technical indicators to confirm trading decisions.

5. Combining EMA with Other Indicators:

To enhance the accuracy of trading strategies, traders often combine EMA with other indicators such as Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Bollinger Bands.

6. Advantages and Limitations of EMA:

The EMA offers several advantages, including its responsiveness to recent price changes and its ability to adapt to volatile market conditions. However, it also has limitations, such as potential false signals during choppy market periods.

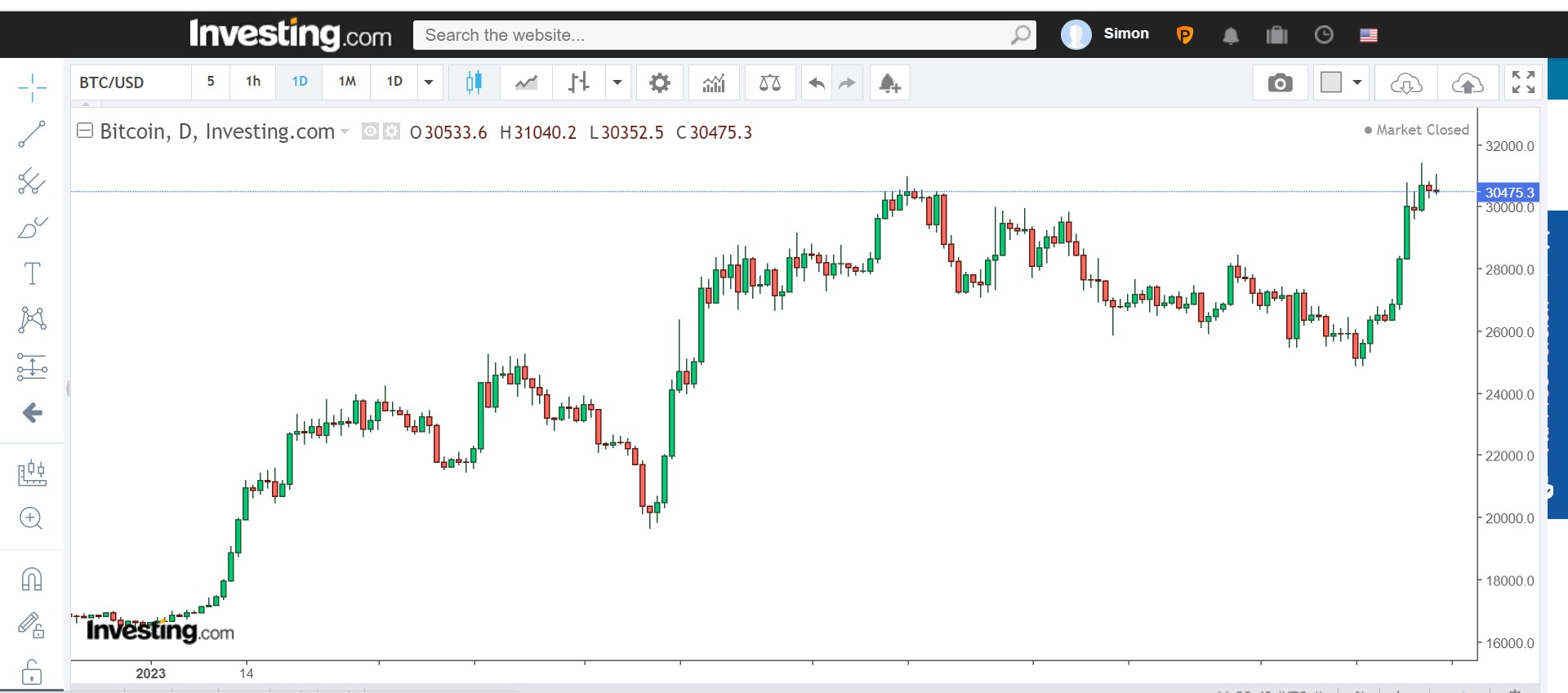

7. Real-World Examples of EMA Usage:

This section will provide practical examples of how traders utilize EMA in different market scenarios, showcasing its effectiveness in various trading strategies.

In conclusion, the Exponential Moving Average is a powerful technical indicator that aids traders in identifying trends, determining support and resistance levels, and generating trading signals. By understanding its calculation methodology, interpretation techniques, and practical applications, traders can incorporate EMA into their trading strategies effectively.

Ole Borgesen / Pyjamastraders