How to Select the Right Stock Broker Platform

Investing in the stock market can be a lucrative endeavor, but it requires careful planning and decision making. One aspect of successful investing is choosing the right stock broker platform. With numerous options available, selecting the best platform that aligns with your investment goals and preferences can be a little overwhelming. In this blog post, we will provide you with a guide on how to select a stock broker platform that suits your needs for you style of trading.

1. Determine Your Investment Goals

Before diving into the world of stock broker platforms, it is essential to define your investment goals. Are you looking for long-term investments or short-term trading opportunities? Do you prefer a hands-on approach or would you rather have a professional manage your portfolio? Understanding your investment objectives will help narrow down the features and services you require from a stock broker platform.

2. Research Different Types of Stock Brokers

There are various types of stock brokers available, each offering different services and catering to different types of investors. The three main types are full-service brokers, discount brokers, and robo-advisors.

– Full-Service Brokers: These brokers offer a wide range of services, including personalized advice, research reports, and access to initial public offerings (IPOs). They are suitable for investors who prefer professional guidance and are willing to pay higher fees.

– Discount Brokers: These brokers provide basic trading services at lower costs. They typically offer online platforms with limited research tools and minimal assistance. Discount brokers are ideal for self-directed investors who prefer making their own investment decisions.

– Robo-Advisors: Robo-advisors are automated platforms that use algorithms to create and manage investment portfolios based on an investor’s risk tolerance and financial goals. They are suitable for individuals seeking a hands-off approach to investing.

3. Consider Fees and Commissions

Fees and commissions can significantly impact your investment returns. When selecting a stock broker platform, it is crucial to consider the fee structure. Some brokers charge a flat fee per trade, while others have tiered pricing based on trading volume. Additionally, be aware of any hidden fees, such as account maintenance charges or inactivity fees. Compare the fee structures of different platforms to find one that aligns with your budget and trading frequency.

4. Evaluate Trading Tools and Research Resources

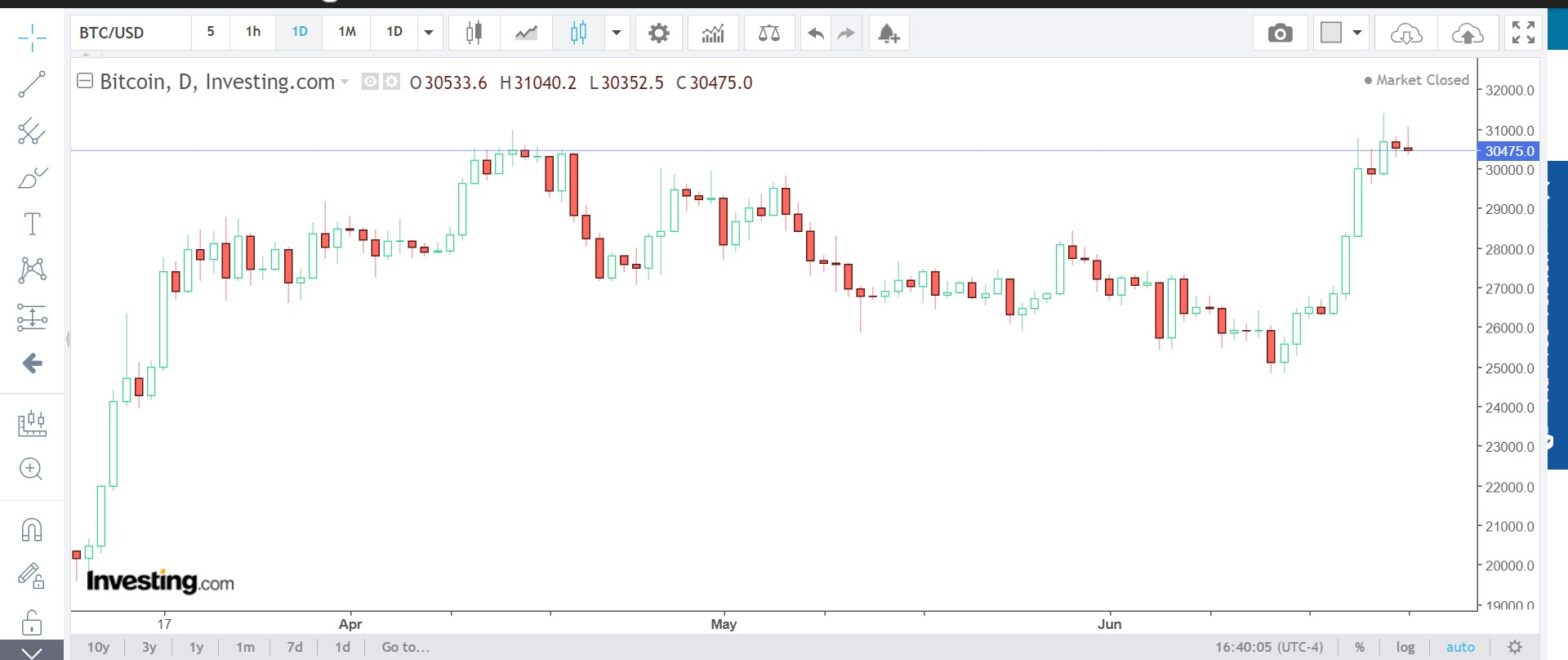

The availability of trading tools and research resources can greatly enhance your investment experience. Look for a stock broker platform that offers a user-friendly interface, real-time market data, advanced charting tools, and customizable watchlists. Additionally, consider the quality and depth of research materials provided by the platform. Access to company reports, analyst recommendations, and educational resources can help you make informed investment decisions.

5. Assess Platform Security and Reliability

Security should be a top priority when selecting a stock broker platform. Ensure that the platform you choose has robust security measures in place to protect your personal information and financial transactions. Look for platforms that utilize encryption technology, two-factor authentication, and secure socket layer (SSL) certificates. Additionally, consider the platform’s reliability and uptime. A stable and responsive platform is essential for executing trades without interruptions.

6. Check Account Types and Minimum Deposit Requirements

Different stock broker platforms offer various types of accounts, such as individual brokerage accounts, retirement accounts (e.g., IRAs), or education savings accounts (e.g., 529 plans). Determine which account types are available on the platform you are considering and ensure they align with your investment needs. Additionally, check the minimum deposit requirements for opening an account. Some platforms have no minimum deposit requirement, while others may require a substantial initial investment.

7. Consider Customer Support and Education

Reliable customer support is crucial when dealing with any financial platform. Look for a stock broker platform that offers multiple channels of customer support, such as phone, email, and live chat. Additionally, consider the availability of educational resources and investor tools. Platforms that provide educational materials, webinars, and tutorials can help you enhance your investing knowledge and skills.

Simon Frandsen / Pyjamastraders