Risk management is an essential aspect of trading that every trader must understand and implement. It involves identifying, assessing, and prioritizing risks associated with trading activities and taking measures to mitigate or avoid them. Effective risk management can help traders minimize losses and maximize profits. In this blog post, we will discuss the importance of risk management in trading and some of the strategies that traders can and must use to manage risks and be successful.

The Importance of Risk Management in Trading Is crucial.

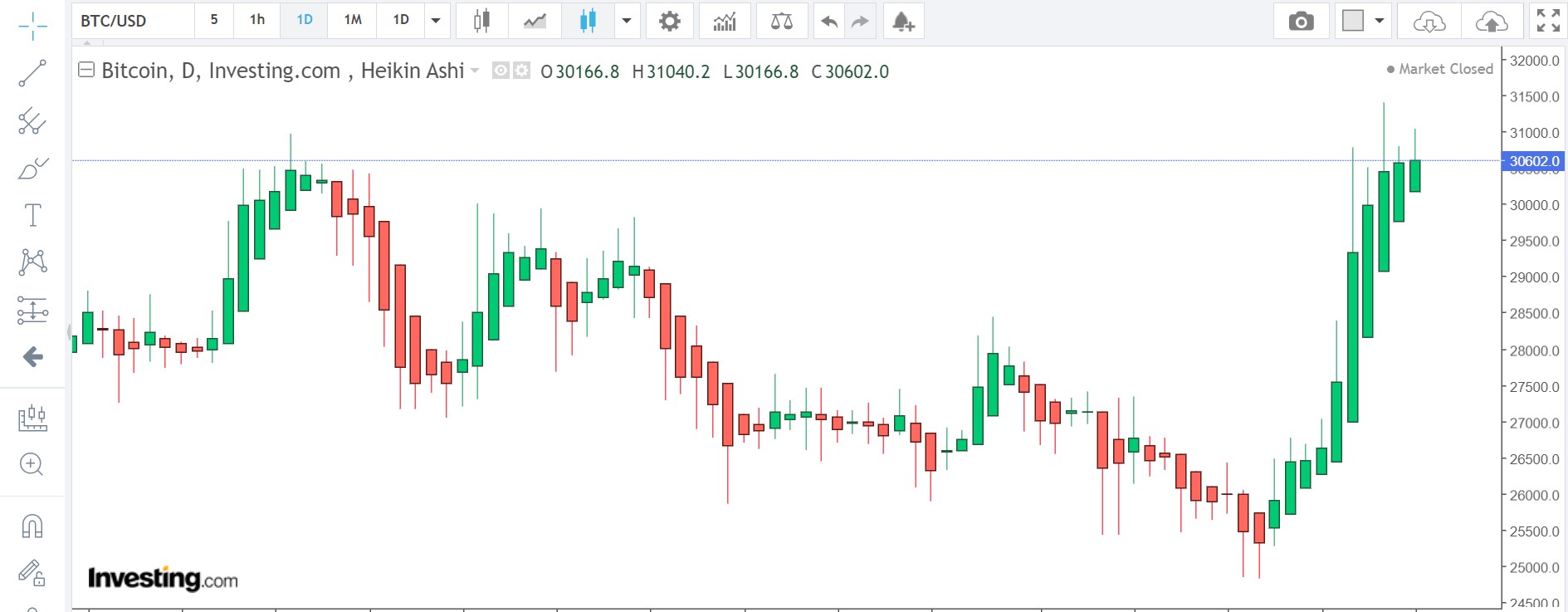

Trading involves a high degree of uncertainty, and there are always risks involved. The market can be unpredictable, and prices can fluctuate rapidly, leading to significant losses for traders who are not prepared. Risk management is crucial in trading because it helps traders identify potential risks and take measures to mitigate them.

One of the most significant benefits of risk management is that it helps traders avoid large losses. By identifying potential risks and taking measures to mitigate them, traders can limit their exposure to losses. This can help them preserve their capital and avoid being wiped out by a single trade.

Another benefit of risk management is that it helps traders stay disciplined. When traders have a clear understanding of the risks involved in their trades, they are less likely to make impulsive decisions based on emotions or speculation. This can help them stay focused on their trading strategy and make more informed decisions.

Strategies for Managing Risks in Trading

There are several strategies that traders can use to manage risks in trading. Here are some of the most effective ones:

1. Stop Loss Orders

Stop loss orders are one of the most popular risk management tools used by traders. A stop loss order is an order placed with a broker to sell a security when it reaches a certain price level. This can help traders limit their losses by automatically closing out a position when the price reaches a predetermined level.

2. Diversification

Diversification is another effective risk management strategy that involves spreading investments across different assets or markets. By diversifying their portfolio, traders can reduce their exposure to any single asset or market and minimize the impact of any losses.

3. Risk/Reward Ratio

The risk/reward ratio is a measure of the potential profit compared to the potential loss of a trade. Traders can use this ratio to determine whether a trade is worth taking based on the potential reward compared to the potential risk. By only taking trades with a favorable risk/reward ratio, traders can limit their exposure to losses and maximize their profits.

Risk management in conjunction with stop loss is the way to control you losses in market.

Risk management is an key aspect of trading that every trader must understand and implement. It involves identifying, assessing, and prioritizing risks associated with trading activities and taking measures to mitigate or avoid them. Effective risk management can help traders minimize losses and maximize profits. Some of the most effective risk management strategies include stop loss orders, diversification, and risk/reward ratio analysis.

Simon Frandsen / Pyjamastraders