Scalping Daytrading

Scalping is a trading strategy that involves buying and selling securities within a short period, usually seconds or minutes, to make small profits. The goal of scalping is to take advantage of small price movements in highly liquid markets. In this blog post, we will explore the concept of scalping in detail, including its advantages and disadvantages, the tools and techniques used in scalping, and some tips for successful scalping.

Advantages of Scalping:

One of the main advantages of scalping is that it allows traders to make quick profits with minimal risk exposure. Since scalpers hold positions for a short time, they are less exposed to market volatility and can exit trades quickly if the market moves against them. Scalping also allows traders to take advantage of small price movements that may not be significant enough for long-term traders but can still generate profits for scalpers.

Another advantage of scalping is that it can be done with relatively low capital requirements. Scalpers do not need large amounts of capital to trade since they are only looking to make small profits on each trade. This makes scalping an attractive option for traders who are just starting and do not have a lot of capital to invest.

Disadvantages of Scalping:

Despite its advantages, scalping also has some disadvantages that traders should be aware of. One major disadvantage is that scalping requires a lot of time and effort. Since scalpers need to monitor the markets closely and make quick decisions, they need to be constantly focused on their trades. This can be mentally exhausting and may not be suitable for all traders.

Another disadvantage of scalping is that it can be challenging to find profitable opportunities consistently. Scalpers need to have a good understanding of market dynamics and use advanced tools and techniques to identify profitable trades. This requires a lot of skill and experience, which may take time to develop.

Tools and Techniques Used in Scalping:

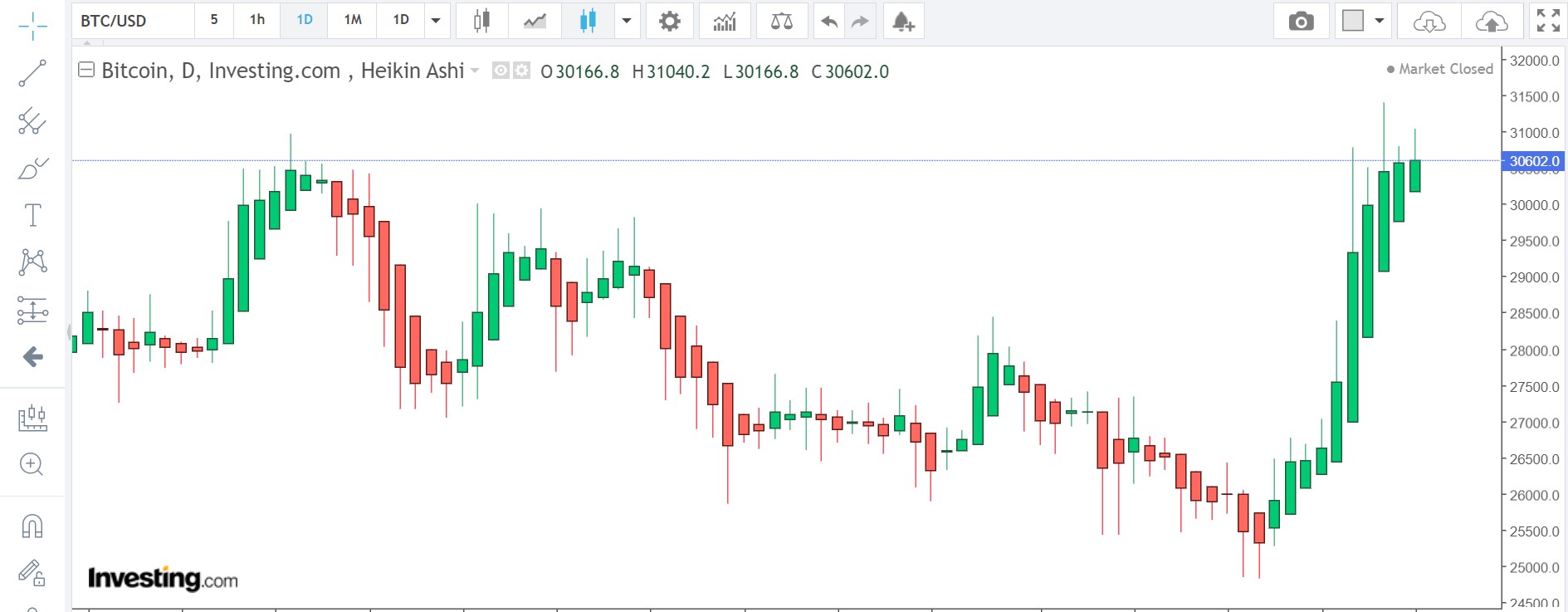

Scalpers use a variety of tools and techniques to identify profitable trades. One of the most popular tools used in scalping is technical analysis. Technical analysis involves using charts and indicators to identify patterns and trends in the market. Scalpers use technical analysis to identify key levels of support and resistance, which can help them enter and exit trades at the right time.

Another technique used in scalping is order flow analysis. Order flow analysis involves tracking the volume of orders being placed in the market and using this information to identify potential trading opportunities. Scalpers use order flow analysis to identify areas of high liquidity, which can help them enter and exit trades quickly.

Tips for Successful Scalping:

To be successful at scalping, traders need to have a solid understanding of market dynamics and use advanced tools and techniques to identify profitable trades. Here are some tips for successful scalping:

1. Use a trading plan: Having a trading plan is essential for scalpers since they need to make quick decisions based on market conditions. A trading plan should include entry and exit points, stop-loss levels, and profit targets. Always keep you stop loss, you might get lucky once or twice, but stop loss is essential to become profitable.

2. Manage risk: Since scalping involves taking small profits on each trade, it is important to manage risk carefully. Traders should use stop-loss orders to limit their losses if the market moves against them.

3. Use advanced tools: Scalpers need to use advanced tools and techniques to identify profitable trades. This includes technical analysis, order flow analysis, and other advanced trading strategies.

Simon / Pyjamastraders