Swing trading is a trading strategy that involves holding positions for a few days to a few weeks. It is a type of short-term trading that aims to capture gains in a stock or other financial instrument over a period of time, typically ranging from a few days to several weeks. In this blog post, we will explore the basics of swing trading, including its advantages and disadvantages, as well as some tips for getting started.

What is Swing Trading?

Swing trading is a type of trading strategy that involves buying and holding stocks or other financial instruments for a short period of time, typically ranging from a few days to several weeks. The goal of swing trading is to capture gains in the market by taking advantage of short-term price movements.

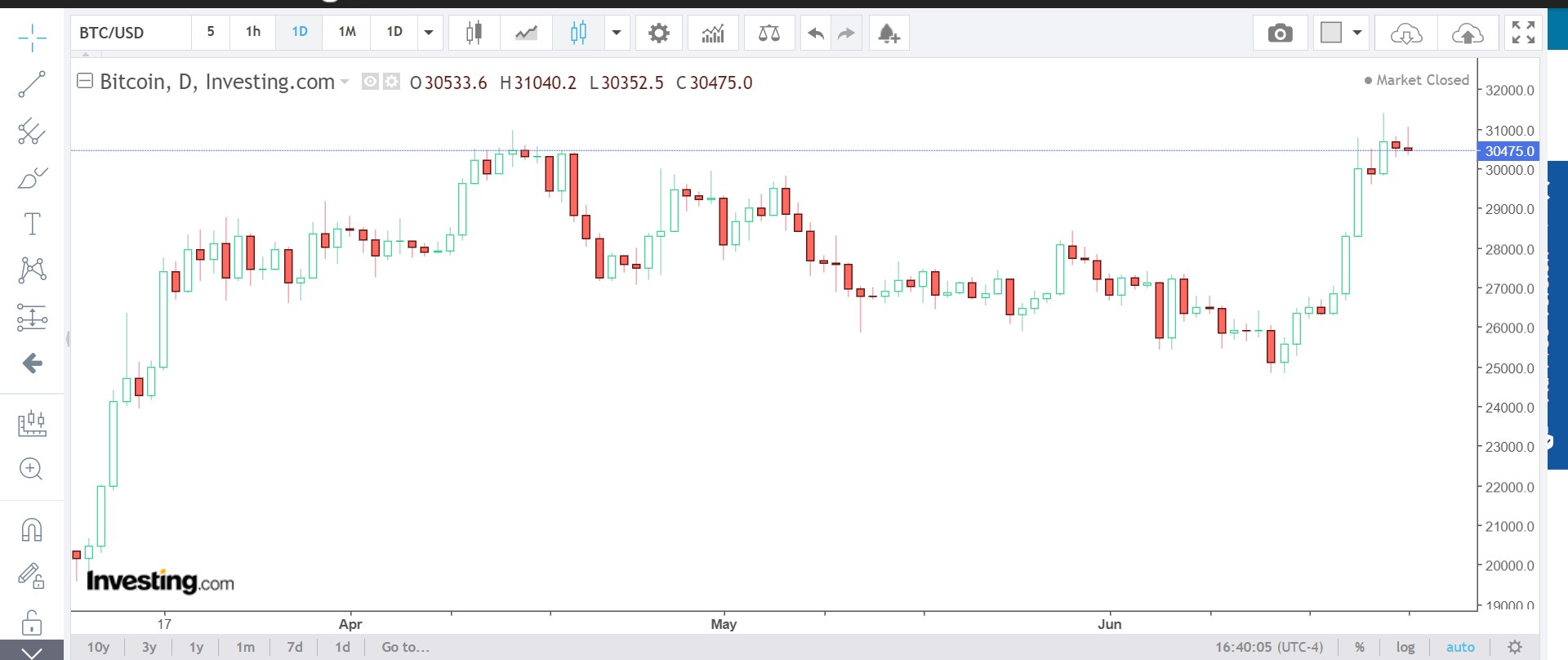

Swing traders use technical analysis to identify potential trades. They look for patterns in the charts and use indicators such as moving averages, relative strength index (RSI), and stochastic oscillators to help them make decisions about when to enter and exit trades.

One of the key advantages of swing trading is that it allows traders to take advantage of short-term price movements without having to hold positions for long periods of time. This can be particularly useful for traders who do not have the time or resources to monitor their positions constantly.

Another advantage of swing trading is that it can be less risky than other types of trading strategies, such as day trading. Because swing traders hold positions for longer periods of time, they are less likely to be affected by sudden market fluctuations or news events that can cause prices to move rapidly.

However, swing trading also has some disadvantages. One of the biggest challenges for swing traders is identifying the right entry and exit points. Because swing traders hold positions for longer periods of time than day traders, they need to be able to identify trends and patterns in the market that will allow them to make profitable trades.

Another challenge for swing traders is managing risk. Because swing traders hold positions for longer periods of time, they are exposed to more risk than day traders. They need to be able to manage their risk effectively by setting stop-loss orders and using other risk management techniques.

Getting Started with Swing Trading

If you are interested in getting started with swing trading, there are a few things you should keep in mind. First, it is important to have a solid understanding of technical analysis and how to read charts. You should also be familiar with the different indicators that swing traders use to identify potential trades.

Second, you should have a clear trading plan in place. This should include your entry and exit points, as well as your risk management strategy. You should also have a plan for how much money you are willing to risk on each trade.

Finally, it is important to start small and gradually build up your positions over time. This will allow you to gain experience and confidence in your trading strategy without risking too much money. Stop loss is a great tool to magae you risk when swing trading.

Conclusion

Swing trading is a popular trading strategy that can be used to capture gains in the market over a short period of time. It has several advantages over other types of trading strategies, including its ability to take advantage of short-term price movements and its lower risk profile.

However, swing trading also has some disadvantages, including the need to identify the right entry and exit points and the need to manage risk effectively. If you are interested in getting started with swing trading, it is important to have a solid understanding of technical analysis and to have a clear trading plan in place.

Overall, swing trading can be a profitable and rewarding trading strategy for those who are willing to put in the time and effort required to master it. Swing trading is one of the most popular ways to invest worldwide.

To dive into more detailed information about swing trading please look at Pyjamastraders blog or search the site.

Simon Frandsen / Pyjamastraders