Trend Following in Trading. Guide to Maximizing Profits

In the world of financial markets, trading strategies play a crucial role in determining success. One such strategy that has gained popularity over the years is trend following. Trend following is a systematic approach to trading that aims to capture profits by identifying and riding market trends. We will in this article look into trend following, exploring its principles, benefits, and implementation strategies.

1: Understanding Trend Following

1.1 Definition and Principles

Trend following is a trading strategy based on the belief that markets tend to move in persistent trends rather than random fluctuations. Traders who follow this approach aim to identify and capitalize on these trends by entering positions in the direction of the prevailing market movement. The core principles of trend following include:

– Riding the trend: Trend followers aim to stay invested in a position as long as the trend persists, allowing them to capture substantial profits.

– Cutting losses short: Implementing strict risk management techniques, trend followers exit losing trades quickly to limit potential losses.

– Letting winners run: Trend followers allow profitable trades to continue until there are clear signs of a trend reversal.

1.2 Historical Background

Trend following has roots dating back to the early 20th century when traders like Jesse Livermore and Richard Donchian began experimenting with systematic approaches to trading. Over time, various trend-following methodologies have been developed and refined, incorporating technical indicators, statistical analysis, and quantitative models.

2: Benefits of Trend Following

2.1 Diversification and Risk Management

Trend following offers diversification benefits by providing exposure to multiple asset classes and markets. By spreading investments across different sectors and geographies, traders can reduce their portfolio’s vulnerability to specific market risks. Additionally, strict risk management techniques employed by trend followers help limit potential losses, preserving capital during unfavorable market conditions.

2.2 Potential for High Returns

Trend following has the potential to generate significant profits during extended market trends. By staying invested in winning trades and capturing a substantial portion of the trend’s movement, traders can achieve above-average returns over time. However, it is important to note that trend following is not a guaranteed path to riches and requires discipline, patience, and adherence to a well-defined trading plan.

Remember to try out PyjamasTraders currency converter

2.3 Emotional Discipline

One of the key advantages of trend following is its ability to remove emotional biases from trading decisions. By relying on predefined rules and objective indicators, traders can avoid impulsive actions driven by fear or greed. This disciplined approach helps maintain consistency in trading strategies and reduces the impact of emotional biases on overall performance.

Section 3: Implementing Trend Following Strategies

3.1 Identifying Trends

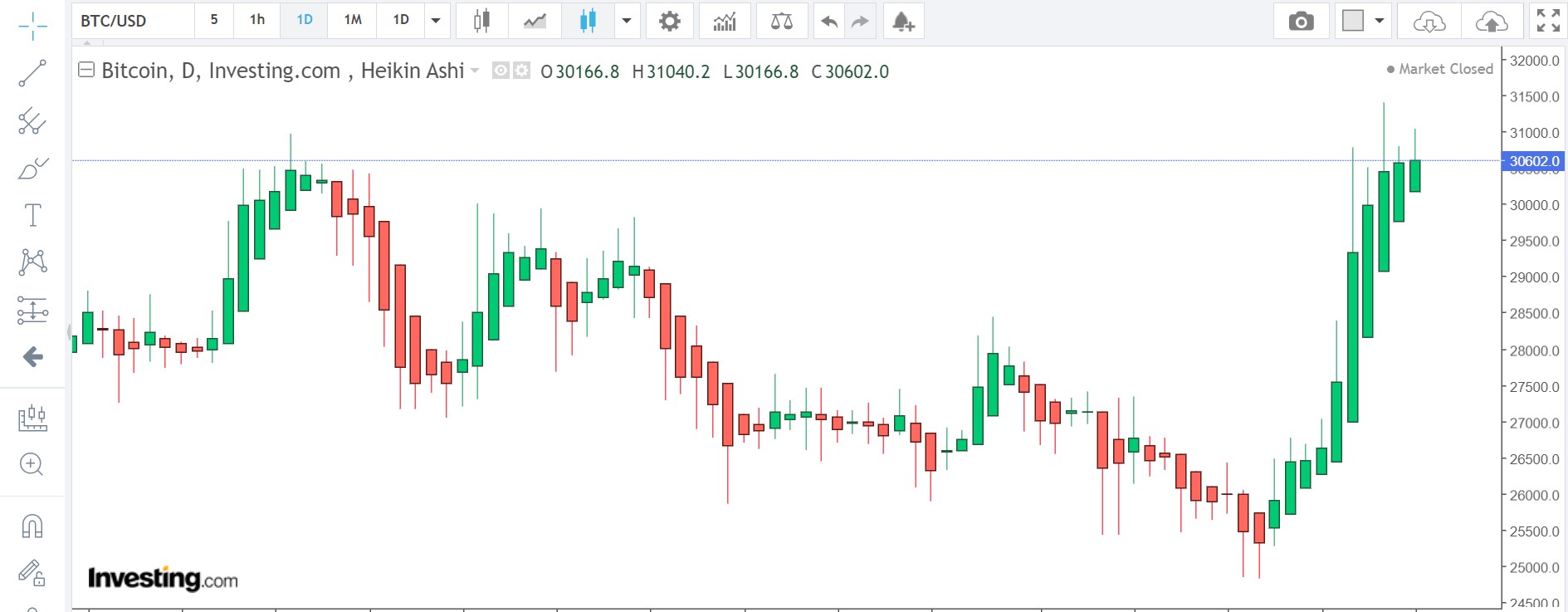

The first step in implementing a trend-following strategy is identifying market trends. Traders use various technical indicators such as moving averages, trendlines, and momentum oscillators to determine the direction and strength of a trend. These indicators help filter out noise and provide objective signals for entering or exiting trades.

3.2 Entry and Exit Signals

Once a trend is identified, traders need clear entry and exit signals to initiate or close positions. Trend followers often use breakout strategies, where they enter trades when prices break above resistance levels or below support levels. Additionally, trailing stop-loss orders are employed to protect profits and exit trades when the trend shows signs of reversal.

3.3 Position Sizing and Risk Management

Proper position sizing and risk management are critical aspects of successful trend following. Traders allocate a specific percentage of their portfolio to each trade based on their risk tolerance and the volatility of the underlying asset. Stop-loss orders are placed at predetermined levels to limit potential losses, ensuring that no single trade can significantly impact overall portfolio performance.

3.4 Backtesting and Optimization

Before implementing a trend-following strategy, it is essential to backtest and optimize the trading system using historical data. This process helps traders evaluate the strategy’s performance, identify potential weaknesses, and make necessary adjustments. Backtesting also provides insights into the strategy’s profitability, drawdowns, and risk-reward characteristics.

4: Challenges and Considerations

4.1 False Signals and Whipsaws

One of the challenges faced by trend followers is the occurrence of false signals and whipsaws. False signals occur when a trade is initiated based on a perceived trend that later reverses, resulting in losses. Whipsaws refer to rapid changes in market direction that can trigger premature exits or entries. Traders must employ robust filtering techniques and risk management rules to mitigate these challenges.

4.2 Market Volatility and Drawdowns

Trend following strategies can experience periods of high volatility and drawdowns, which can test traders’ emotional resilience. During volatile market conditions, trends may be shorter-lived or less pronounced, leading to reduced profitability. Traders must be prepared for such periods and have contingency plans in place to manage risk effectively.

4.3 Psychological Factors

Implementing a trend-following strategy requires discipline, patience, and the ability to stick to predefined rules. Emotional biases such as fear of missing out (FOMO) or reluctance to cut losses can hinder successful trend following. Traders must develop psychological resilience and maintain a long-term perspective to overcome these challenges.

In conclusion, trend following is a very popular trading strategy that aims to capture profits by riding market trends. By adhering to well-defined principles, employing objective indicators, and implementing good and robust risk management techniques, traders can potentially achieve consistent returns over time. However, it is important to recognize the challenges associated with trend following and develop the necessary skills and mindset to navigate them successfully for profit.

Simon Frandsen / Pyjamastraders