Volatility Understanding Its Role in Trading

Trading in volatile markets can be like crossing a busy road blindfolded. The real challenge is not just in surviving the experience but doing so successfully. But what does ‘volatility in trading’ even mean anyway? Can high levels always be harmful, or could they sometimes present us with opportunities?

Understanding Volatility

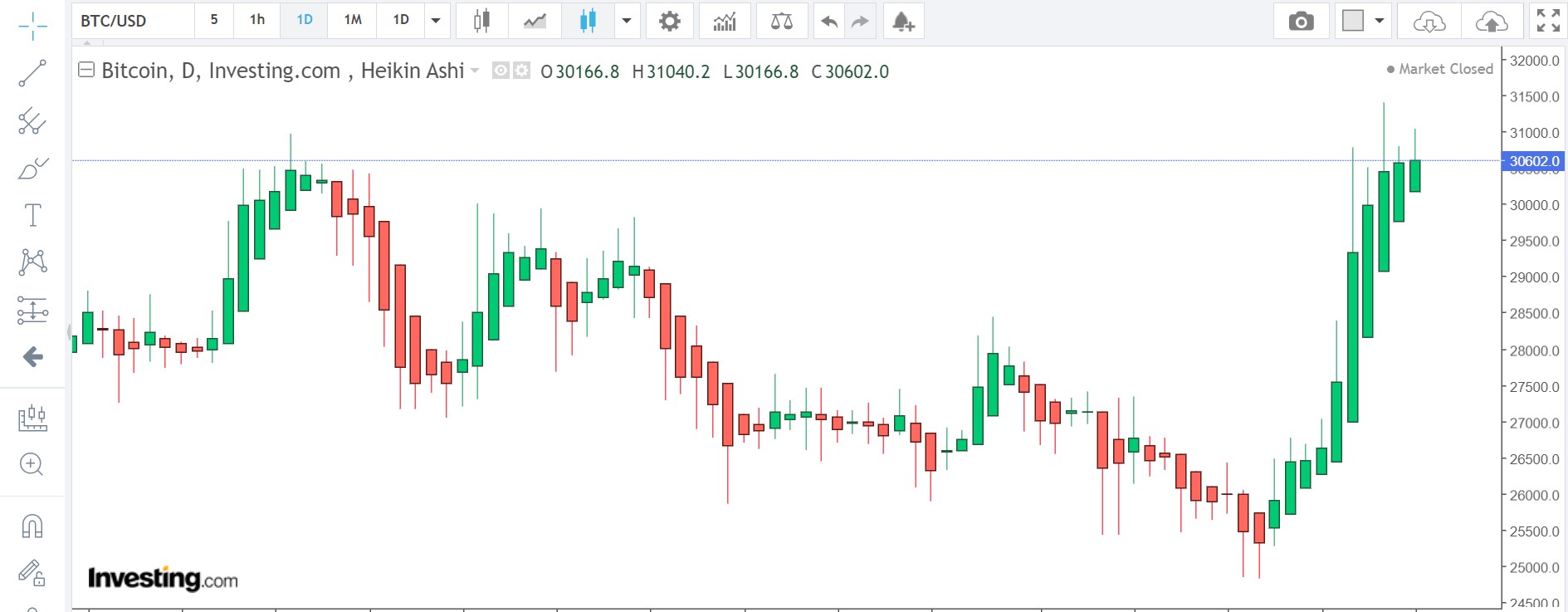

Volatility refers to the degree of variation in the trading prices of a security over a certain period. It is a measure of the security’s instability and is used by both traders and investors to gauge market trends and risks.

Ordinarily, you’d think stability is best. So, why bother with something unstable? Let’s peel back the layers and look at that.

Embracing the Unstable: Why Volatility Matters?

Volatility is not always a harbinger of doom. Those in the trading industry often see high volatility as a sign of potential profit. It certainly adds a fair bit of drama, doesn’t it? However, remember that with high rewards comes high risk.

How does that work? Well, a fluctuation in prices can afford traders the opportunity to purchase securities at low costs and then sell them when their prices escalate. This ‘buy low, sell high’ strategy is a basic principle of trading.

Managing Volatility

With high volatility comes risk, but fear not. There are ways to manage and even capitalize on market volatility.

One common approach is diversification – the practice of spreading your investments across various financial instruments, industries, and other categories to mitigate potential risks.

For more aggressive traders, derivatives like options and futures provide an avenue to profit from volatility.

Benefits and Drawbacks of Volatility

Like most things in life, volatility has its pros and cons. As previously mentioned, the key benefit is the potential for greater profits. However, the downside is the higher risk factor which can lead to significant losses.

So, the next time you’re contemplating a trade, remember Volatility is a double-edged sword, as potent in promise as it is potent in risk.

In Conclusion

Ask not what the volatility in trading has in store for you, but what you can accomplish with it. Would it be tumultuous? Certainly. But like the proverbial oyster, sometimes, a bit of unrest can yield pearls of great value.

Always remember, every market condition presents an opportunity. It’s just a matter of defining your strategy, taking calculated risks, and embracing a bit of volatility. After all, without a bit of a storm, there won’t be any rainbows, would there?

So, take the leap and embrace the volatile nature of trading. With the right tools, even the storm can be tamed.

Simon Frandsen / Pyjamastraders